All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Assuming rate of interest prices remain solid, even higher guaranteed rates could be feasible. Utilizing a laddering approach, your annuity portfolio renews every couple of years to make best use of liquidity.

MYGA's are one of the most preferred and one of the most usual. With multi-year accounts, the price is secured for your picked duration. Prices are ensured by the insurer and will neither enhance neither lower over the selected term. We see interest in short-term annuities providing 2, 3, and 5-year terms.

Nyl Annuities Tpd

Which is best, straightforward rate of interest or compounding passion annuities? The response to that depends on exactly how you utilize your account. If you don't prepare on withdrawing your interest, after that normally supplies the greatest prices. The majority of insurance coverage business just supply worsening annuity plans. There are, nevertheless, a few policies that credit scores basic rate of interest.

Everything depends upon the underlying rate of the taken care of annuity agreement, of course. We can run the numbers and contrast them for you. Allow us know your intentions with your passion earnings and we'll make suitable recommendations. Experienced repaired annuity financiers know their premiums and rate of interest gains are 100% available at the end of their chosen term.

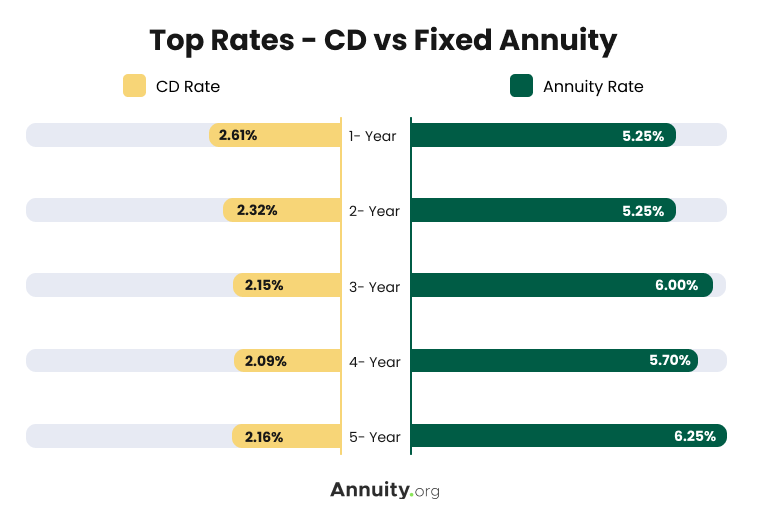

Unlike CDs, fixed annuity policies permit you to withdraw your rate of interest as income for as long as you wish. And annuities supply greater rates of return than mostly all similar financial institution tools supplied today. The various other item of good news: Annuity prices are the highest they have actually been in years! We see considerably even more passion in MYGA accounts now.

There are several very ranked insurance policy companies competing for down payments. There are several popular and highly-rated firms supplying affordable returns. And there are agencies specializing in ranking annuity insurance coverage companies.

These qualities increase or down based on a number of variables. Luckily, insurance provider are normally secure and safe organizations. Extremely couple of ever before fall short since they are not permitted to offer your deposits like financial institutions. There are several ranked at or near A+ offering some of the very best returns. A few that you will see above are Reliance Criterion Life, sibling business Midland and North American Life, Americo, Oxford Life, American National, Royal Neighbors, Pacific Guardian Life, Athene, Sagicor, Global Atlantic, and Aspida among others.

They are secure and reliable plans developed for risk-averse financiers. The investment they most very closely resemble is deposit slips (CDs) at the financial institution. View this brief video to understand the similarities and differences in between the two: Our clients acquire repaired annuities for numerous reasons. Safety and security of principal and guaranteed rates of interest are definitely two of the most crucial factors.

American Pathway Fixed Annuity

We help those needing instant passion revenue now as well as those preparing for future revenue. It's crucial to note that if you need earnings now, annuities work best for those over age 59 1/2.

Why deal with us? We are an independent annuity broker agent with over 25 years of experience. We are certified with all service providers so you can shop and contrast them in one location. Rates are scooting and we don't recognize what's on the perspective. We help our clients secure the highest possible yields feasible with risk-free and protected insurance companies.

In recent times, a wave of retiring baby boomers and high rate of interest have actually helped fuel record-breaking sales in the annuity market. From 2022 to 2024, annuity sales topped $1.1 trillion, according to Limra, an international research company for the insurance policy industry. In 2023 alone, annuity sales raised 23 percent over the prior year.

Fisher Investments Annuity Guide

With more potential passion rate cuts coming up, straightforward fixed annuities which often tend to be much less challenging than various other options on the marketplace may become much less appealing to consumers as a result of their winding down prices. In their place, various other ranges, such as index-linked annuities, may see a bump as customers look for to record market growth.

These price walkings gave insurance coverage companies area to supply more appealing terms on fixed and fixed-index annuities. "Rate of interest on fixed annuities additionally climbed, making them an eye-catching investment," says Hodgens. Also after the securities market rebounded, netting a 24 percent gain in 2023, sticking around fears of a recession kept annuities in the limelight.

Other elements also added to the annuity sales boom, including more financial institutions now using the products, states Sheryl J. Moore, CEO of Wink Inc., an insurance market research firm. "Customers are reading about annuities more than they would've in the past," she says. It's likewise less complicated to buy an annuity than it utilized to be.

"Literally, you can obtain an annuity with your agent with an iPad and the annuity is authorized after completing an on the internet form," Moore states. "It made use of to take weeks to obtain an annuity via the problem process." Set annuities have actually thrust the recent development in the annuity market, standing for over 40 percent of sales in 2023.

However Limra is expecting a draw back in the popularity of fixed annuities in 2025. Sales of fixed-rate deferred annuities are expected to drop 15 percent to 25 percent as rate of interest decrease. Still, repaired annuities have not lost their sparkle fairly yet and are providing conventional financiers an appealing return of greater than 5 percent in the meantime.

Annuity Lifetime Income Rider

Variable annuities often come with a laundry list of fees death expenditures, administrative expenses and financial investment administration fees, to name a couple of. Fixed annuities maintain it lean, making them a less complex, less costly option.

Annuities are intricate and a bit various from other economic items. (FIAs) damaged sales documents for the 3rd year in a row in 2024. Sales have actually almost doubled considering that 2021, according to Limra.

However, caps can differ based on the insurance firm, and aren't likely to stay high permanently. "As interest rates have actually been coming down recently and are expected to come down additionally in 2025, we would prepare for the cap or engagement rates to also boil down," Hodgens claims. Hodgens anticipates FIAs will certainly stay attractive in 2025, however if you remain in the marketplace for a fixed-index annuity, there are a few points to keep an eye out for.

So theoretically, these crossbreed indices intend to ravel the highs and lows of an unpredictable market, however actually, they have actually often failed for customers. "Most of these indices have returned little to absolutely nothing over the past pair of years," Moore claims. That's a hard pill to ingest, considering the S&P 500 posted gains of 24 percent in 2023 and 23 percent in 2024.

The more you study and shop about, the much more likely you are to locate a credible insurance provider happy to offer you a good price. Variable annuities as soon as controlled the marketplace, yet that's altered in a huge means. These products endured their worst sales on document in 2023, going down 17 percent contrasted to 2022, according to Limra.

Single Premium Immediate Annuities

Unlike dealt with annuities, which supply drawback security, or FIAs, which balance security with some growth capacity, variable annuities provide little to no defense from market loss unless riders are tacked on at an added price. For investors whose leading concern is protecting capital, variable annuities merely do not determine up. These items are additionally notoriously intricate with a background of high costs and substantial surrender fees.

However when the market fell down, these riders became liabilities for insurance companies since their assured worths went beyond the annuity account values. "So insurer repriced their bikers to have much less appealing attributes for a higher price," states Moore. While the industry has made some efforts to improve openness and minimize prices, the product's past has actually soured several consumers and financial consultants, that still view variable annuities with hesitation.

Future Value Annuity Tables

RILAs use consumers much higher caps than fixed-index annuities. Exactly how can insurance policy companies pay for to do this?

For instance, the variety of crediting methods utilized by RILAs can make it tough to compare one product to another. Greater caps on returns also include a trade-off: You tackle some danger of loss beyond a set floor or buffer. This buffer shields your account from the very first section of losses, typically 10 to 20 percent, yet after that, you'll lose cash.

Latest Posts

Glenbrook Life And Annuity

New York Life Single Premium Immediate Annuity

Annuities Bogleheads